Blog

- Home

- Blog details

Recent Blogs

-

Crane applications of steel wire ropes

26 Apr 2024 -

GALVANIZED WIRE ROPE

03 Apr 2024 -

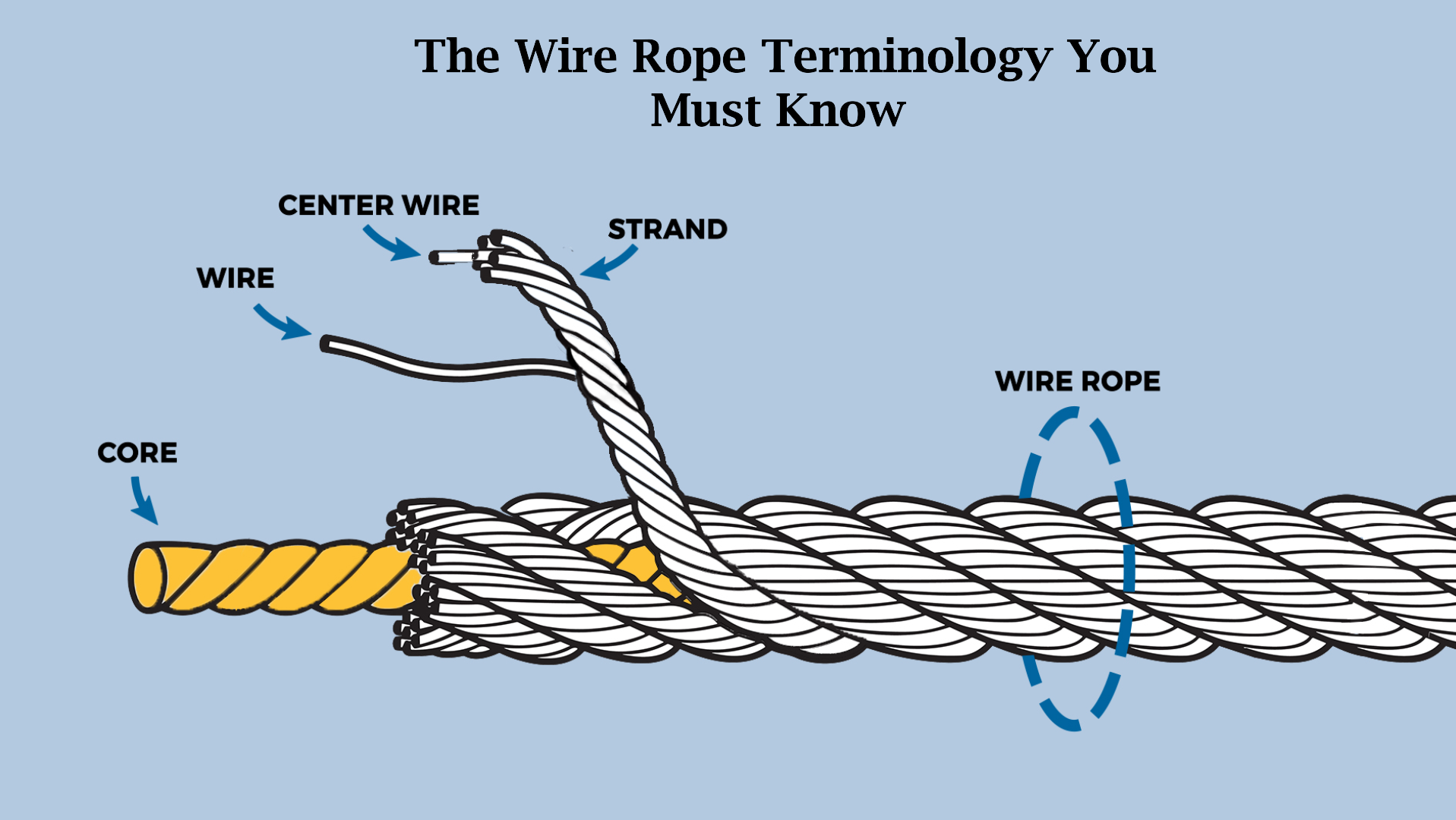

The Wire Rope Terminology You Must Know

26 Mar 2024 -

-