Wire Rope Industry set for major gains

The role of the wire rope industry in anchoring the

dreams and aspirations of any country cannot be understated. From general

engineering to deep sea exploration/mining which is of strategic

significance wire ropes find a wide variety of applications in different

sectors. Likewise, the factors that affect growth in the wire rope industry are

also varied, and necessitate a comprehensive analysis.

The following text attempts to familiarize readers with the

wire rope industry, and how the steel and infrastructure sector drives growth

in this crucial subsector.

Wire Ropes: A Value-Added Steel Product

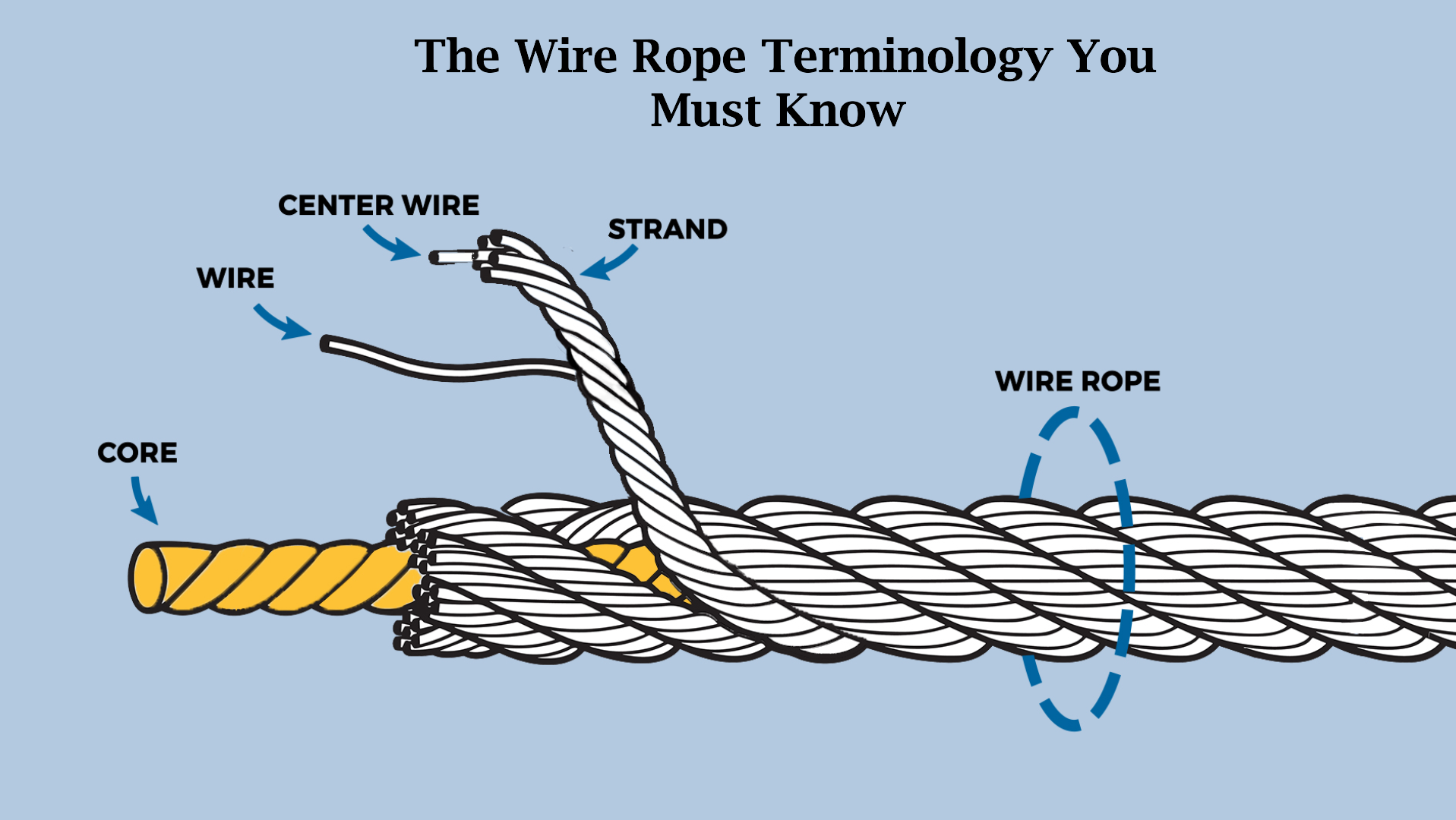

Wire ropes are a value-added product derived from wire rods,

and come under the long steel category of steel products. The value chain of

wire rope industry progresses as follows manufacture of wires using wire

rods, then strands from wires, and culminating in the manufacture of wire ropes

from strands. Any player which has an overawing presence throughout the value

chain is expected to come up trumps, and this is where leading wire rope

companies like Bharat Wire Ropes Ltd holds the edge in the wire rope

manufacturing sector in India. As with any other industry, the fortunes of the

wire rope industry depend on growth and investment in the infrastructure

segment. Any slowdown in infrastructure projects and activities negatively

impacts the wire rope industry. Implementation delays can inflate costs, and

following changes in government regulations the viability and sustainability of

the whole project can be jeopardized. A correlation can be drawn between the

wire rope industry and the steel industry on the basis of the fact that wire

ropes are derived from steel. This does call for a general understanding of the

steel industry in India.

A Quick Brief of the Steel Industry:

The Indian Steel industry is the world's fourth largest producer of steel for the fifth year in a row in CY14. As per a report by Credit Analysis & Research Limited (CARE), Steel majors in India have been on a rapid expansion drive evidenced by a CAGR of 8.4% from FY10-FY15. India is targeting an increase in installed capacity from 101 MTPA to 300 MTPA in the next decade, which will boost demand for steel in the country. The per capita consumption of steel in India in 2014 was 59 kg compared to the world average of 225 kg a surefire indicator of the potential for growth that the domestic steel industry holds. The steel industry has witnessed sluggish growth over the last few years, and this holds good for both the domestic and international market. The CAGR of 7.5% achieved during FY10-13 slid down to an abysmal 2% during FY 13-15. Though there was an upsurge in domestic demand during FY15 compared to the previous financial year, the domestic growth continues to lag behind previous estimates. The slow growth is mainly attributable to policy paralysis. Moreover, high interest rates have hampered growth in the consumer durables and automobile industry, which invariably has affected steel demand from these sectors.

Sluggish demand notwithstanding, there is no dearth of steel availability given that steel capacity has increased at a CAGR of 7.7% from about 48 million tons in FY05 to about 101 million tons in FY15. (Report on Indian Steel & Wire Rope Industry, 2015) Going forward, CARE Research expects domestic steel capacity to increase at a CAGR of 5% during FY15-FY18. These figures do point to an impressible increase in steel output, but they may fail to keep pace with corresponding rise in domestic steel demand in coming times.

Intertwined Fortunes: Infrastructure Industry and Steel Wire Rope Industry

The CARE report further states that the funding which takes place for infrastructure projects tends to be long term in nature. Uncertain political climate coupled with high interest rates is acting as a detriment for private sector investments in India. In such a scenario, growth in the infrastructure segment requires unwavering government support. In the 11thh Five Year Plan, funds from the Central and State Governments accounted for half of the total investments made in the infrastructure segment. The remaining investment was covered by Debt accounting, equity or FDI. The 12th Five Year Plan has stipulated investment in the infrastructure segment equaling 10 percent of GDP growth in order to realize the Governments targeted 9 percent real GDP growth – this translates to an investment requirement of Rs. 40 lakh crores when calculated on the basis of 2006-07 real term prices, and to achieve this kind of investment is a monumental task for any government – even the current one.

Growth in infrastructure is characterized by hectic activity in the construction, engineering and capital goods sectors these constitute almost 60% of end-use consumption pattern of the steel wire rope industry. (Report on Indian Steel & Wire Rope Industry, 2015) Needless to say, strong growth in the infrastructure industry bodes well for the wire rope industry. Few of the areas where wire ropes are utilized in the constructing and engineering domain include material handling, mining, ports and shipping, construction equipment, construction of bridges, escalators and elevators, amongst others. CARE Research foresees growth in the manufacturing sector on the back of government initiatives such as Make in India campaign, which, in turn, will drive up demand for steel wire ropes.

Current Outlook:

After years of unpredictability, capital investment is finally showing signs of resurgence. However, manufacturing activity is yet to pick up under the Government Make in India campaign. The spending on infrastructure projects has also reduced on account of global economic downturn. Growth in the core sectors has slid down from 6.5% in 2013 to 2.7% last year. (Report on Indian Steel & Wire Rope Industry, 2015) Unless the Government takes urgent measures to recover from the slide, one cannot be too hopeful of growth in the infrastructure sector anytime soon.

Infrastructure sector has been accorded high priority It

has been acknowledged as the sine qua non for long-lasting growth as per an Economic Times article (as cited in Economic

Survey 2015-16). The wire rope manufacturing and steel industry can only hope

that things change for the better by the time the tenure of the current

government ends.

References

Report on Indian Steel & Wire Rope Industry June 30, 2015, Credit Analysis & Research Ltd.

Economic Survey 2015-16, Ministry of Finance, Government of India: State of the Economy: An Overview (2016, Feb 26th), p. 124, http://indiabudget.nic.in/survey.asp

You can also get in touch with us by messaging us on LinkedIn- https://www.linkedin.com/company/bharatwireropes